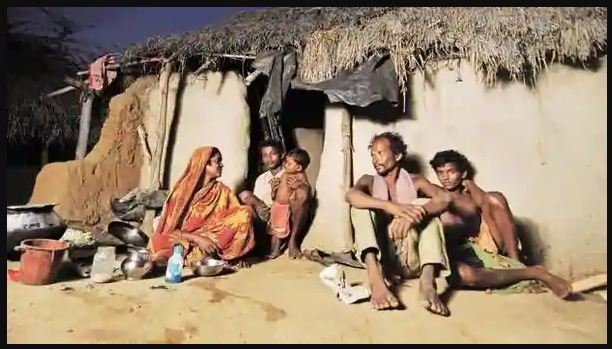

In the best of times, India’s poor lives a fragile life. And now when the whole

world is going through a terrible time, the most affected people are poor

people.

The circumstance is not only terrible but also unstable. The lockdown of the nation in the course of recent months has frustrated everybody and it has hit the urban poor the hardest.

Estimating defenselessness precisely is troublesome however an investigation dependent on information from legitimate sources recommends that even in the most hopeful situation, near 30% of India’s urban populace could be out of reserve funds and unfit to cover fundamental consumption by June-end. Conversely, the rustic poor, however, hit hard, are generally happier with still a few investment funds, and government assistance backing to fall on.

As indicated by one study, 84% of family units endured a loss in income since the lockdown. As livelihoods fell, Indians needed to depend more on their investment funds to cover basic use. Be that as it may, for the most unfortunate in urban areas, these reserve funds quickly evaporated. To evaluate how rapidly investment funds are running out, we consider various situations of salary misfortunes for the least fortunate half of Indians (country and urban independently) during the lockdown. For example, in the direst outcome imaginable, we expect salaries in urban areas fell by a normal of 82% over the three periods of lockdown among April and June while in provincial India, which was less influenced by the lockdown, we accept livelihoods fell by 66%. These situations depend on various examinations that all report pay misfortunes inside these reaches.

Taking a moderate situation of livelihoods falling by 62% in urban territories and a half in rural zones, near 92 million urban Indians (20% of the urban populace) and 89 million country Indians (10% of the provincial populace) came up short on reserve funds to subsidize basic utilization after the initial 21-day lockdown.

Given the government administration’s help to poor and faster reviving of the economy in rural areas, we gauge country Indians would have the option to cover basic utilization till June end. Be that as it may, in urban India, around 139 million Indians (30% of the urban populace) would at present come up short on reserve funds before the current month’s over.

We create proportions of helplessness by figuring the amount of the month to month basic utilization (which includes spending for food, wellbeing, lease, training, force and cooking gas) can be secured by existing reserve funds, government support (both in-kind and DBT), and considering the pay stun they encountered in the recent months.

Poor urban Indians have been hit more enthusiastically on the grounds that they spend considerably more on fundamentals while having a lot of littler investment funds to swear by. For example, information recommends that the least fortunate 20 percent in urban communities have lower reserve funds than their rural counterparts yet at the same time spend significantly more on basic consumption. Contrasting pre-lockdown investment funds with the evaluated balance at June-end shows that the base 30% of urban family units would need to either chop down basic use or acquire to cover it. In any event, for other people, there has been a huge disintegration of reserve funds. For urban family units between the fourth and fifth urban deciles, reserve funds fell by 37% during the lockdown. Little marvel then that the lockdown activated such a mass migration from urban areas.