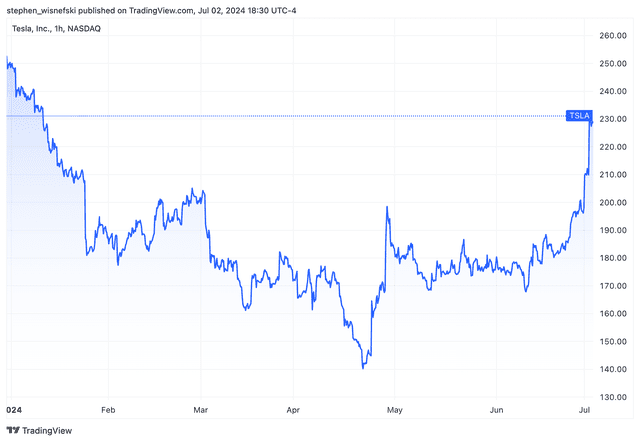

Hang on to your charging cables, Tesla fans! Following a few quarters that were below par from the expectations of analysts, Tesla stock is back on the fast lane. The pioneer in electric vehicles has just reported that it had made a massive beat on its second-quarter deliveries; the stock price surged over 8% in pre-market trading. Many investors began to ponder: did Tesla get back on track for long-term dominance in the EV market?

Delivery Numbers Beat Forecasts

Background information is that the key driver behind the stock jump is due to fantastic delivery numbers. It announced the production of approximately 411,000 vehicles and delivered about 444,000 vehicles in Q2 2024, which beats analyst estimates of deliveries at 436,000—indicating strong production and sales for the quarter.

Even with deliveries down 4.7% year over year versus Q2 2023, the positive beat on expectations is clearly a needed boost for Tesla investors. It may indicate that the company is getting over some of the recent rough patches, such as supply chain problems and increased competition in the EV segment.

Model 3 and Model Y Continue to Rule Sales

The breakdown of delivered vehicles shows that core models from Tesla—the Model 3 and Model Y—continue to dominate. Over 422,000 units of such popular EVs found their way to owners during Q2, continuing to top the bestseller lists of EVs in global markets. That continuous strength is waged as a demonstration of standing demand by customers for Tesla’s core products.

Is Tesla Still the Undisputed EV King?

Even in the light of all the positive news, many analysts would have a word of caution. Current year-over-year delivery decline, along with concerns regarding production ramp-up for the Cybertruck and Tesla Semi, suggests Tesla might have some problems retaining its current market share. Furthermore, traditional automakers are quickly entering the EV space with competitive product offerings that will certainly put more pressure on Tesla’s stronghold.

Ahead: Earnings Report and Long-Term Prospects Of Tesla Stock

While the beat in deliveries offers some succor to investors, it really only captures part of the picture. Tesla is set to release its earnings report in mid-July that will have a full outline of the company’s overall financial health, including profit margins, production costs, and future investment plans—things crucial to the long-term trajectory of the Tesla Stock.

Investor Takeaway: A Positive Sign, But More to Consider

Strong delivery numbers and a stock jump on the back of them will have been positive for Tesla—it says the company is standing up against some of the recent challenges and keeps up good demand for its core products. But investors must not get too carried away. It is the long-term factors—competition, ramping up production of new models, and overall financial performance—which witnessed the dictation that Tesla would so rightly succeed in times to come.

Tesla Stock and the Evolving EV Landscape

That said, the really rapidly changing landscape in the electric vehicle market is something that cannot just be wished away. The old big three of the carmakers –General Motors, Ford, and Chrysler are investing aggressively in EV production, with more models rolled out to compete directly against Tesla. Not forgetting the new startups in EV production, such as Rivian and Lucid Motors, who are really raising waves in the industry by bringing in some promising vehicles. This increased competition will undoubtedly force Tesla to adapt and innovate to continue competing amid the market tussle.

A Turning Point for Tesla?

The Q2 delivery beat by Tesla is a big step in the right direction. Though the company cannot be termed back at the pinnacle, it is quite too preliminary to make that declaration at this point. How the upcoming earnings report shapes up and how well Tesla can manage the increasingly competitive EV market will be the most important deciding factors for long-term success. These are things that investors would want to monitor closely to drive their decision-making vis-à-vis their Tesla holdings.