Intel has been making headlines again, and this time, it’s for all the right reasons. The company’s stock jumped after a report emerged about a possible multibillion-dollar investment from Apollo Global Management.

For a tech company that has struggled recently, this is welcome news. But what does this mean for Intel’s future, and how will it impact investors? Let’s break down the key developments and see where things stand.

The Apollo Investment: What’s the Buzz?

Bloomberg recently reported that Apollo Global Management, a well-known private equity firm, might be looking to invest up to $5 billion. This news sent Intel’s stock up by 2% on Monday, September 23, 2024, following a 3% boost last Friday, which was fueled by speculation of another deal—one involving Qualcomm.

This isn’t the first time Intel and Apollo have crossed paths. Earlier this year, in June, it sold an $11 billion stake in its Ireland-based manufacturing facility to Apollo. So, their relationship isn’t new, and this potential investment doesn’t seem too far-fetched. If it happens, this could be a significant boost especially as it tries to regain some footing in the tech world.

Qualcomm Rumors: A Merger in the Works?

While Apollo’s investment news has sparked excitement, there’s another big rumor swirling around Intel: a possible takeover by Qualcomm. The mere mention of this deal pushed the stock higher last week, but it didn’t go as well for Qualcomm. Their stock dropped about 3%, signaling some hesitation from investors.

Why the hesitation? Well, many analysts believe a Qualcomm-Intel merger is a long shot, primarily due to regulatory hurdles. The U.S. government has been cracking down on big tech mergers lately, and a deal this big would probably face heavy scrutiny. Think back to Nvidia’s failed attempt to acquire ARM Holdings or Broadcom’s effort to buy Qualcomm a few years ago—both deals were shot down by regulators.

Even if the merger did somehow go through, not everyone thinks it’s a good idea. Some analysts believe the company should focus on other areas and that merging with Qualcomm wouldn’t necessarily benefit Intel or its shareholders.

Intel’s Struggles in the AI Race

Now, it’s no secret that the company has had a tough time lately. The company has been trailing behind rivals like Nvidia and AMD, particularly in the AI chip market. These competitors have taken a big lead, with companies like Amazon, Google, and Microsoft showing a lot of interest in their advanced AI chips.

Intel, on the other hand, hasn’t had as much luck. Its Gaudi AI processors were released too late, after most of the major players had already started working on their own AI chips. This delay has left Intel in a tricky spot, as it tries to catch up in an industry that’s moving at lightning speed.

In response to these challenges, the company has been cutting costs and restructuring. In August 2024, the company announced plans to lay off 15% of its workforce, with a goal of saving $10 billion. On top of that, Intel has paused some of its projects in Europe as it tries to streamline its operations.

Even with all these efforts, Intel’s stock is down nearly 57% since the beginning of the year. This shows just how tough things have been for the company.

Could Apollo’s Investment Change Intel’s Fortune?

So, will Apollo’s potential $5 billion investment turn things around for Intel? It’s possible, but opinions are divided. Some experts think that Intel should consider getting out of the foundry business altogether. The foundry business, where Intel manufactures chips for other companies, has struggled to compete with more successful rivals like Nvidia and AMD.

Citi analysts have suggested that the company should rethink its foundry strategy. They argue that the company has a slim chance of becoming a profitable foundry, especially with the level of competition in the market right now.

Stacy Rasgon, a senior analyst at Bernstein, shares a similar sentiment. She believes that Intel might find it hard to justify the risks of continuing in the foundry business and that exiting might be in the company’s best interest.

Intel’s Recent Moves: Is There Hope?

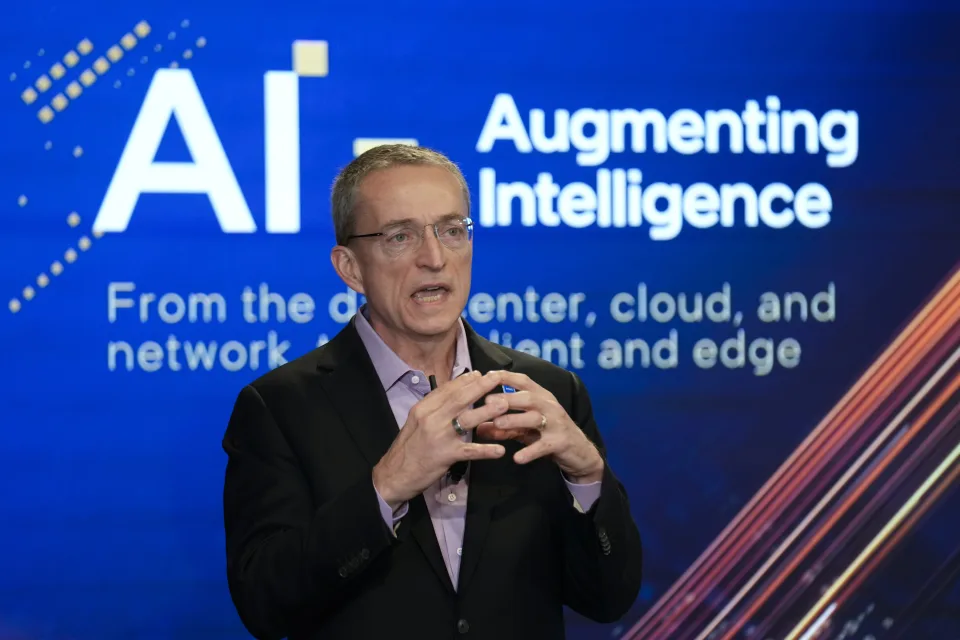

While things have been tough, the company has made some positive moves recently. Just last week, CEO Pat Gelsinger announced a multibillion-dollar partnership with Amazon Web Services (AWS). On top of that, Intel is set to receive $3 billion in funding from the CHIPS Act, a U.S. government initiative aimed at boosting domestic semiconductor manufacturing.

Gelsinger has been upbeat about these developments, saying that it is making progress in building a world-class foundry business. While this sounds promising, it’s clear that Intel still has a lot of work to do if it wants to compete with the likes of Nvidia and AMD.

What’s Next for Intel?

For now, the potential Apollo investment has given Intel’s stock a much-needed boost. But the company still faces a long road ahead, especially as it tries to compete in the AI chip market. The next few months will be crucial as it makes strategic decisions that could determine its future.

For investors, Apollo’s possible investment is a positive sign, but it’s important to remain cautious. Its long-term success will depend on more than just financial backing—it will need to innovate and find ways to stay competitive in a rapidly changing tech landscape.

Final Thoughts

Intel’s recent stock surge may have grabbed headlines, but the company still has a lot to prove. With Apollo’s potential $5 billion investment on the table and rumors of a Qualcomm takeover, it is at a crossroads.

However, significant challenges remain, especially in the AI chip space, where competitors have surged ahead. While Apollo’s interest may provide some hope, Intel will need more than just financial support to regain its competitive edge. Investors should keep an eye on the company’s next moves as it continues to navigate these uncertain waters.